We will tell you how the average salary is calculated in the program “1C: Salaries and Personnel of a Government Institution 8”.

Setting up a base for calculating average earnings

The basis for calculating average earnings is determined by the accounting procedure for each type of accrual according to its purpose (section “Settings” – “Accruals”). The procedure for accounting for accruals in calculating average earnings in the program is determined automatically in accordance with the law. Independent determination of the procedure for accounting for accruals in average earnings is possible only for accruals with a purpose “Other accruals and payments.”

Most of the accruals that are included in the average earnings calculation base are taken into account as "Total earnings", that is, in the amount of the accrued amount for the period for which it was accrued. For accruals with purpose "Prize" There are four accounting options available: “Premium, fully taken into account”, “Annual bonus, fully taken into account”, “Premium, partially taken into account”, “Annual bonus, partially taken into account”.

Flag “When calculating average earnings, this accrual is indexed” active if the organization performs indexation of employee earnings.

Please note that when an organization’s salary increases during the billing period, the legislation provides for an increase in payments taken into account when calculating the average for the months preceding this increase.

For the convenience of mass viewing or editing of the database settings for calculating average earnings in the list of all accruals (section “Settings” – “Accruals”) a button is provided “Setting up personal income tax, average earnings, etc.”

On the tab " Average earnings (business trips, vacations, etc.)" the left tabular part displays a list of accruals that determine the base of average earnings, the right tabular part displays a list of accruals that are not taken into account in the calculation. If an accrual needs to be transferred from one tabular part to another, you must select the appropriate accrual and click on the button with the arrow to transfer (and if transferring an accrual is not available, this means that the program has already determined the accounting procedure for the selected accrual (according to the law, these settings cannot be changed ).

Read also How to ensure the functioning of the OSMS: actions and plans of the employer

Determining the billing period for calculating average earnings

Calculation of average earnings in the program is carried out in the documents: “Sick leave”, “Vacation”, “Business trip”, “Parental leave”, “Payment for days of care for disabled children”, “Absence with pay”, “Employee downtime”, “One-time accrual”, “Dismissal” "

The calculation period for calculating average earnings is automatically defined as 12 calendar months preceding the start date of the event, except for the case when the average earnings are calculated in the month the employee was hired - then the calculation period is 1 calendar month - the month the employee was hired. If the collective agreement provides for a different period for calculating the average salary, then it can be set manually directly when calculating in the form (opens by clicking the button with a green pencil in the section "Average earnings") document with the help of which the saved average earnings are calculated by setting the switch to the position "Specified manually."

The payroll period may also need to be changed manually if the employee did not have accrued wages and days worked in it, but did have time in the previous payroll period.

Calculation of average earnings in cases not related to vacation pay

The algorithm for calculating average earnings described in the article is used for accruals with assignments: “Payment for business trips”, “Payment for time maintained by average earnings”, “Payment for downtime due to the fault of the employer”, “Payment for days caring for disabled children”, “Severance pay”, “Other accruals and payments”.

When calculating, the employee’s accruals for each month of the billing period are first determined, as well as the number of days and hours actually worked. The results obtained are reflected in the form “Inputting data to calculate average earnings”. Next, based on these data, the employee’s average daily (average hourly) earnings are calculated and the result of the accrual calculated based on average earnings is calculated.

We talk about the nuances of calculating average earnings and give examples of setting up the base for calculating average earnings in “1C: Salary and Personnel Management 8” edition 3.

In cases determined by the legislation of the Russian Federation, the employee must be paid in the form of average earnings, and not wages. The procedure for calculating the average salary for sick leave and, for example, business trips and vacations, differs. 1C experts clarify what you need to know about calculating average earnings in accordance with Decree of the Government of the Russian Federation of December 24, 2007 No. 922 for cases provided for by the Labor Code of the Russian Federation, and also provide examples of setting up the base for calculating average earnings in “1C: Salary and Personnel Management 8” edition 3 and the impact of deviations from the employee’s work schedule on the calculation.

In what cases is average earnings calculated?

The term “average earnings” is used in regulatory documents to describe calculation rules in different cases. Sick days, vacations, business trips and others are paid based on average earnings. At the same time, average earnings are calculated in different ways. Thus, Federal Law No. 255-FZ dated December 29, 2006 and Government Decree No. 375 dated June 15, 2007 determine the procedure for calculating benefits for temporary disability, pregnancy and childbirth, and child care until the child reaches 1.5 years of age.

The general rules for calculating average earnings for cases where an employee was not at work, but according to the Labor Code such earnings were retained, are established in Article 139 of the Labor Code of the Russian Federation.

The calculation procedure is defined in Decree of the Government of the Russian Federation dated December 27, 2007 No. 922 (hereinafter referred to as Decree No. 922).

This article discusses the calculation of average earnings in accordance with Article 139 of the Labor Code of the Russian Federation and Resolution No. 922.

This resolution defines a different procedure for calculating average earnings for two cases:

1. Vacation and compensation for unused vacation.

2. Other cases provided for by the Labor Code of the Russian Federation (except for cases of determining the average earnings of workers for whom a summarized recording of working time is established).

Cases named in the Labor Code of the Russian Federation when average earnings are maintained:

- business trip (Article 167 of the Labor Code of the Russian Federation);

- passing a medical examination (Article 185 of the Labor Code of the Russian Federation);

- transfer of an employee to another job (Articles 72.2 and 182 of the Labor Code of the Russian Federation);

- donation of blood and its components (Article 186 of the Labor Code of the Russian Federation);

- employee participation in collective bargaining (Article 39 of the Labor Code of the Russian Federation);

- failure to comply with labor standards, failure to fulfill labor (official) duties through the fault of the employer (Article 155 of the Labor Code of the Russian Federation);

- etc.

The Labor Code of the Russian Federation establishes a non-closed list of cases of maintaining average earnings.

The formulas for calculating average earnings are different for the first and second cases, but in each of them you need to know the billing period, the number of days worked in the billing period, and the actual earnings of the employee received in the billing period.

Billing period

In general, the billing period consists of 12 months preceding the month in which average earnings were maintained (clause 4 of Resolution No. 922).

In accordance with Article 139 of the Labor Code of the Russian Federation, the employer may establish a different pay period if this does not worsen the situation of employees.

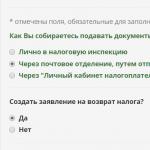

In the program "1C: Salary and Personnel Management 8" edition 3 in documents registering days of payment based on average earnings (for example, Vacation, Business trip), there is a pencil icon - Change data for calculating average earnings(Fig. 1).

Rice. 1. Changing the billing period

When you click on it, a window opens Entering data to calculate average earnings. Switch Calculation period of average earnings provides the ability to select a period: Standard, determined automatically And Set manually.

If local regulatory documents provide for a billing period other than 12 months, then when working with such documents in the program, the user should independently control that Average earnings, calculated according to the manually set billing period, was no less than according to the standard one. It is convenient to carry out control in the form , moving the switch.

The billing period includes the time of actual work. If, for example, an employment contract with an employee was concluded less than 12 months before calculating average earnings, then in the standard calculation period (12 previous months) the time before hiring will be excluded.

That is, the billing period does not change, but unworked time is allocated in it. The list of excluded periods is defined in paragraph 5 of Resolution No. 922.

Thus, the time when the employee:

- received average earnings (excluding breaks to feed the child);

- was on maternity leave and sick leave;

- did not work due to downtime due to the fault of the employer or due to circumstances beyond the control of the parties;

- could not work due to a strike in which he did not participate;

- used additional paid days to care for a disabled child;

- in other cases, he was released from work with full or partial retention of earnings or without it.

The 1C: Salaries and Personnel Management 8 program, edition 3, provides for the exclusion of such periods.

Setting up excluded periods is carried out in the calculation type card (menu Settings - Accruals) on the tab Average earnings.

If the flag is not established, then the period and earnings for this period are excluded from the calculation of the average.

When there are no days worked in the billing period, the calculation is made based on the current month.

For example, a business trip or vacation occurs in the month when an employment contract was concluded with the employee. In the shape of Entering data to calculate average earnings button Add according to payroll data fills in the data for calculating average earnings with information from the current month.

Actual earnings

When calculating average earnings, the employee’s actual earnings include all types of payments provided for by the remuneration system and accrued to the employee in the billing period, regardless of the source of funds. In other words, the calculation of the average includes all payments established by the employer in the remuneration system as wages.

In addition, the following are included in the calculation:

- allowances and additional payments to tariff rates and salaries for professional skills, experience, knowledge of a foreign language, combining professions, increasing the volume of work, etc.;

- payments related to working conditions (regional coefficients, additional payments for work in harmful, dangerous and difficult conditions, for working overtime at night, on days off);

- bonuses and remunerations provided for by the remuneration system, fixed in local regulations;

- other types of wage payments from the employer.

note, one-time bonuses that are not included in the remuneration system do not participate in the calculation of average earnings. In the program "1C: Salaries and Personnel Management 8" edition 3, all types of calculations that have Purpose of accrual - Bonus, are necessarily included in the calculation of average earnings.

Flag Include in the accrual base when calculating average earnings in the calculation type card on the tab Average earnings for such accruals is set by default and is not available for switching. For bonuses that are not included in average earnings, new types of calculation should be created with Purpose of accrual - Other accruals and payments.

Calculation of average earnings for...

...all cases except holidays

The calculation of average earnings for all cases, except vacation, is made using the same formula, but depends on the remuneration system, more precisely, on the method of time recording.

If an employee is set to a summed working time regime, then the calculation is carried out by the hour, and the average hourly earnings of the SCHZ are calculated using the formula:

SchZ = ZP / FHF,

Where:

HPF- actual time worked in hours;

Salary- earnings accrued to the employee for the pay period.

If an employee does not have a summarized working time regime, then the calculation is carried out by day and the average daily earnings SDZ is calculated using the formula:

SDZ = ZP / FVd,

Where FVd- actual time worked in days.

To calculate the average earnings for the period, in this case, the average daily earnings are multiplied by the payable time on the employee’s schedule in days.

However, not in all cases the time subject to payment is calculated according to the schedule. The exception is payment for donor days. In letters dated 03/01/2017 No. 14-2/ОOG-1727 and dated 10/31/2016 No. 14-2/B-1087, the Russian Ministry of Labor explained that payment for days of donating blood and its components should be made based on an eight-hour working day, regardless of the schedule employee.

...vacations

When calculating average earnings for the purpose of calculating vacation, regardless of the method of recording working time, accounting is carried out by day.

The average daily earnings of SDZ is calculated according to the formula:

SDZ = Salary / 29.3 x Month + Dnep,

Where:

Months- number of complete calendar months worked;

Dnep- the number of days in incomplete calendar months, calculated by the formula:

Dnep = 29.3 / CD x OD,

Where:

KD- number of calendar days in a month;

OD- number of days worked.

Examples of the influence of deviations from the work schedule on the calculation of average earnings

Let’s consider how the calculation of an employee’s average earnings is affected by deviations from his work schedule, for example, due to being on vacation, a business trip, etc.

Example 1

When calculating vacation (Fig. 2), the average daily earnings amounted to 1,022.68 rubles. (RUB 358,571.43/350.62 days). In November, one day was not worked, and earnings amounted to 28,571.43 rubles. The month of November is not fully taken into account - 28.32. In total, 358,571.43 rubles were accrued for the billing period. and 350.62 days are taken into account.

Rice. 2. Calculation of average earnings for vacation, Example 1

When calculating a business trip (Fig. 3), the average daily earnings amounted to 1,451.71 rubles. (RUB 358,571.43 / 247 days). In total, 358,571.43 rubles were accrued for the billing period. and 247 days worked were taken into account.

Rice. 3. Calculation of average earnings for a business trip, Example 1

Example 2

When calculating vacation (Fig. 4), the average daily earnings amounted to 1,019.83 rubles. (358,571.43 rubles / 351.6 days), which is less than in Example 1. The fact is that the time off affected the employee’s earnings - in November 28,571.43 rubles were accrued, as with any other absence . But time off does not reduce the number of days worked, and the month is considered fully worked. In total, 358,571.43 rubles were accrued for the billing period. and 351.6 days were taken into account.

Rice. 4. Calculation of average earnings for vacation, Example 2

However, when calculating a business trip, time off is not included in the number of days actually worked, and the average earnings are 1,451.71 rubles, as in Example 1 (see Fig. 3).

Example 3

When calculating vacation (Fig. 5), the average daily earnings amounted to 1,032.18 rubles. (362,914.98 rubles / 351.6 days), which is more than in Example 1. The fact is that working on a day off affected the employee’s earnings - 32,914.98 rubles were accrued in November. But working on a day off does not change the fact of a fully worked month, and a coefficient of 29.3 is used for calculation. In total, 362,914.98 rubles were accrued for the billing period. and 351.6 days were taken into account.

Rice. 5. Calculation of average earnings for vacation, Example 3

When calculating a business trip, working on a weekend increases the days actually worked, and the average earnings are 1,457.49 rubles. (RUB 362,914.98 / 249 days). In total, 362,914.98 rubles were accrued for the billing period. and 249 days worked were taken into account (Fig. 6).

Rice. 6. Calculation of average earnings for a business trip, Example 3

From the editor. Get even more information about the rules for calculating average earnings, about accounting for bonuses, about the indexation of average earnings when salaries increase, about the provisions on calculating average earnings in local documents, and also get acquainted with other examples of calculating average earnings in the 1C: Salary and Personnel Management program 8" edition 3 can be found from

According to current legislation, the calculation base for calculating average earnings includes all types of wages, with the exception of social and other payments (compensation for medical examinations, travel and food, training expenses, etc.). Depending on the settings of the information base, the above accruals can either be indexed or remain unchanged (the only exception is non-indexed accruals that are not tied to the employee’s salary, for example, an additional payment in the amount). This setting can be seen in the Settings – Payroll section – checkbox “Employee earnings are indexed”.

When the checkbox is enabled in the accrual type settings, the accrual indexation checkbox becomes active. This opportunity is provided just for such cases when you need to indicate whether the accrual is subject to indexation or not. (Section Settings – Accruals).

Compensatory payments are not taken into account when calculating average earnings. And if we create (or select from the list of available ones) an accrual, then when we select the accrual purpose “Compensation payments”, the Average Earnings section becomes unavailable for editing.

Some types of accruals make it possible to independently determine whether they are included in the base for calculating the average or not. For example, material assistance related to covering the needs of an employee is classified as social payments and is not taken into account in the calculation. And financial assistance for vacation (if stipulated in the collective agreement) refers to incentive payments and is taken into account when calculating average earnings. If in the form of an accrual, its inclusion in the calculation has been changed, then in order to update the accumulation register without resorting to re-posting all payroll documents, you can use the “Update data for calculating average earnings” service, which is located in the “Salary” section.

It is inconvenient to analyze the settings of the average earnings base through a separate accrual. Therefore, in the configuration it is possible to massively view all the accruals included in the database. To do this, in the Settings – Accruals section, click the button “Setting up personal income tax, average earnings, etc.”

As you can see in the figure, the setting consists of two columns: on the left are all charges that determine the base, on the right are all those not taken into account. To change the accounting order, simply move the accrual from one column to another. At the same time, here we can immediately change the order of indexation of accruals.

After setting up the base, we can go directly to the accruals themselves, calculated on the basis of average earnings. Such accruals include paid vacations, business trips, days of incapacity for work, days of caring for a disabled child, and paid downtime. By default, the accruals include a calculation period of 12 months (this norm is established by Article 139 of the Labor Code of the Russian Federation), but if a different period is specified in the collective agreement, setting up the accrual allows us to correct it.

In accrual documents (e.g. Business trip, Vacation, Sick leave, etc.) there is a separate data entry form for calculating average earnings. This form collects the entire employee’s earnings for all accruals that make up the average base, taking into account the number of days actually worked. Based on these data, the average daily (average hourly earnings of the employee) is calculated.

If you still have questions about calculating average earnings in 1C ZUP, we will be happy to answer them as part of a free consultation.

Vladimir Ilyukov

The procedure for calculating average earnings to pay for annual leave, time spent on a business trip and in other cases of maintaining average earnings provided for by labor legislation is established in Art. 139 Labor Code of the Russian Federation and in Decree of the Government of the Russian Federation dated December 24, 2007 No. 922 “On the specifics of the procedure for calculating average wages”, further Resolution No. 922. This procedure is laid down in the algorithms for calculating average earnings in the 1C ZUP 3.1 program.

All cases when an employee who is absent or not working for a good reason retains his average earnings are established in different places of the Labor Code of the Russian Federation. It is important to keep in mind that the uniform procedure for calculating average earnings distinguishes between two groups of absences.

Paid holidays (compensation)

- Annual paid leave, Art. 114 Labor Code of the Russian Federation.

- Compensation for unused vacation, art. 126-127 Labor Code of the Russian Federation.

- Additional study leaves, art. 173-174, 176 Labor Code of the Russian Federation.

Other cases of absence provided for by the Labor Code of the Russian Federation

- Business trips, art. 167 Labor Code of the Russian Federation.

- Downtime due to the fault of the employer, Art. 157 Labor Code of the Russian Federation.

- Advanced training, art. 187 Labor Code of the Russian Federation.

- Donation of blood and its components (donor days), art. 186 Labor Code of the Russian Federation.

- Severance pay in connection with dismissal due to liquidation of the organization, reduction of staff (number) of employees, conscription of the employee for military service; Art. 178 Labor Code of the Russian Federation.

- And other.

1.1 Average earnings

Average earnings are determined by multiplying the duration of the period in days (hours) by the average daily (hourly) earnings, respectively.

1.1.1 Average daily earnings

Average daily earnings are determined based on the average monthly number of calendar or actually worked days in the billing period. On this issue in para. 3 tbsp. 139 Labor Code of the Russian Federation

“Under any operating mode, the average employee’s salary is calculated based on from the salary actually accrued to him and actually worked them time for 12 calendar months preceding the period during which the employee retains his average salary. In this case, the calendar month is considered to be the period from the 1st to the 30th (31st) day of the corresponding month inclusive (in February - to the 28th (29th) day inclusive).”

- Leave (compensation) in calendar days. To pay for vacations and compensation for unused vacations, provided in calendar days ( Art. 120 Labor Code of the Russian Federation), average daily earnings are calculated for the last 12 calendar months by dividing the amount of accrued wages by 12 and by 29.3 (average monthly number of calendar days), para. 4 tbsp. 139 Labor Code of the Russian Federation.

- Vacations in working days. To pay for vacations and compensation for unused vacations provided in working days ( Art. 291 and art. 295 Labor Code of the Russian Federation), average daily earnings are calculated by dividing the amount of accrued wages by the number of working days according to the calendar of a six-day working week, para. 5 tbsp. 139 Labor Code of the Russian Federation.

- Other cases. These are business trips, downtime due to the employer’s fault, and any other absences when the employee retains his average earnings in accordance with the Labor Code of the Russian Federation. In all such cases, with the exception of the average earnings of employees for whom summarized working time recording is established, average daily earnings are calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations, by the number of days actually worked during this period; para. 3 tbsp. 139 Labor Code of the Russian Federation, clause 9 of Resolution No. 922.

In accordance with clause 9 of Resolution No. 922 The average employee's earnings are calculated by multiplying the average daily earnings by the number of calendar or working days (D) in the period subject to payment

1.1.2 Average hourly earnings

The need to calculate average hourly earnings is mentioned in clause 13 of Resolution No. 922. It is stated here verbatim that

Clause 13 of Resolution No. 922.

In accordance with para. 3 clause 13 of Resolution No. 922 The average employee's earnings are calculated by multiplying the average hourly earnings by the number of working hours according to the employee's schedule in the period subject to payment

1.2 Accounting for time and payments when calculating average earnings

Not all working days and payments are included in the calculation of average earnings. This is especially important to keep in mind if the user creates new accruals in the 1C ZUP 3.1 program.

1.2.1 Time and amounts of payments excluded from the calculation of average earnings

A closed list of periods and payments that are excluded from the calculation of average earnings is established in clause 5 of Decree No. 922. Analysis of this list allows us to formulate the following rule.

Periods of time for which the employee had previously received maintained average earnings or accrued social benefits are excluded from the calculation of average earnings.

Is it necessary to exclude absenteeism due to the employee’s fault from the payroll period?

There is no clear and unambiguous answer to this question in the legislation. So, in para. 3 tbsp. 139 Labor Code of the Russian Federation It has been established that it is necessary to calculate the average salary of an employee taking into account the salary actually accrued to him and the time actually worked by him in the billing period. Absenteeism caused by the employee is not considered working days, and they are not included in the actual time worked. It follows that absenteeism due to the fault of the employee must be excluded from the calculation of average earnings.

At the same time, in the closed list of periods ( clause 5 of Decree No. 922), which are excluded from the calculation of average earnings, absenteeism due to the fault of the employee is not mentioned. It follows from this that absenteeism due to the fault of the employee is not excluded from the calculation of average earnings.

In the old letter of the Ministry of Labor and Social Development of the Russian Federation dated July 10, 2003 N 1139-21 based clause 5 of Decree No. 922 It was concluded that absenteeism without a valid reason is not excluded from the calculation of average earnings.

This conclusion is somewhat questionable. In the hierarchy of regulatory legal acts, Federal laws and codes equivalent to them are higher than decrees of the Government of the Russian Federation. Therefore, for formal reasons, absenteeism should be excluded from the calculation of average earnings. But such a decision will lead to injustice: the more absenteeism, the higher the average daily earnings!

To resolve this injustice, let us recall that the legislation gives the employer the right not to pay for absenteeism without a good reason, para. 3 tbsp. 155 Labor Code of the Russian Federation. It is logical that this right would extend to the calculation of the average earnings of absentees. This right can be exercised by including absenteeism in the pay period, as provided clause 5 of Decree No. 922.

1.2.2 Payment amounts taken into account when calculating average earnings

The calculation of average earnings includes all payments provided for by the remuneration system. Their list is set to Clause 2 of Resolution No. 922. However, it may also include other types of wage payments applicable to the relevant employer.

For example, a bonus provided for by the wage system is taken into account in calculating average earnings. But the anniversary bonus cannot be taken into account when calculating average earnings.

1.3 Payment of vacations by calendar days

The duration of paid annual leave, both basic and additional, is calculated in calendar days. Wherein non-working holidays falling during the vacation period are not included in the number of calendar days of vacation, Art. 120 Labor Code of the Russian Federation. According to Art. 112 Labor Code of the Russian Federation The following days are non-working holidays in Russia.

This exception is made only for non-working holidays. Weekends falling during the vacation period are included in the total duration of vacation.

For example, an employee has been granted annual leave for 28 calendar days since 02/01/2018. If there were no holidays this month, the employee would have to go to work on March 1 (February has 28 calendar days). However, during the vacation period there is a public holiday: February 23 (Defender of the Fatherland Day) and it falls on Friday. Since holidays, unlike weekends, are not included in the vacation period, the employee must return to work on March 2.

The formula for calculating average daily earnings for payment of vacations and compensation for unused vacations provided in calendar days depends on the billing period. Let's look at these formulas. In them, FNZpt is actually accrued payments for the billing period.

1.3.1 All months of the billing period are fully worked out

In cases where all days in the billing period have been worked, the average daily earnings are calculated in the manner provided for in paragraph . 1 clause 10 of Resolution No. 922.

“The average daily earnings for payment of vacations provided in calendar days and payment of compensation for unused vacations are calculated by dividing the amount of wages actually accrued for the billing period by 12 and by the average monthly number of calendar days (29.3).”

Paragraph 1 point 10 of Resolution No. 922.

1.3.2 Not all months of the billing period have been fully worked out

For these cases, the procedure provided for in para. 2-3 clause 10 of Resolution No. 922.

“If one or more months of the billing period are not fully worked out or time is excluded from it in accordance with paragraph 5 of these Regulations, the average daily earnings are calculated by dividing the amount of actually accrued wages for the billing period by the sum of the average monthly number of calendar days (29.3 ), multiplied by the number of complete calendar months, and the number of calendar days in incomplete calendar months.

The number of calendar days in an incomplete calendar month is calculated by dividing the average monthly number of calendar days (29.3) by the number of calendar days of this month and multiplying by the number of calendar days falling on the time worked in this month.”

Paragraphs 2-3 clause 10 Resolution No. 922

This order is reflected by the formula

Here K is the number of fully worked months in the billing period, M is the number of calendar days in incompletely worked months of the billing period.

The number of calendar days in a calendar month that is not fully worked is calculated by dividing the average monthly number of calendar days (29.3) by the number of calendar days of this month and multiplying by the number of calendar days corresponding to the time worked in this month, para. 3 clause 10 of Resolution No. 922.

Let's assume that an employee goes on vacation from 06/09/2018. In the billing period (from 06/01/2017 to 05/31/2018) it did not work from 03/25/2018 to 04/10/2018 inclusive.

The number of calendar days that fall within the time worked in March is 31-6=25, and in April 30-10=20. From here we find the average number of calendar days in the billing period

1.3.3 There is no billing period

It is assumed that in the month of hiring the employee begins the period of maintaining average earnings. For example, on April 1 an employee was hired, and on April 23 he went on another vacation or went on a business trip. Similar options are described clause 7 of Resolution No. 922.

“If the employee did not have actually accrued wages or actually worked days for the billing period and before the start of the billing period, the average earnings are determined based on the amount of wages actually accrued for the days actually worked by the employee in the month of occurrence of the event that is associated with maintaining the average earnings.” .

Point 7 Resolution No. 922

This norm does not directly indicate how many days the amounts paid must be divided into in order to calculate the average daily earnings for vacation pay (vacation compensation). But it is given in para. 4 tbsp. 139 Labor Code of the Russian Federation: to calculate vacation (vacation compensation), you must use the average monthly number of calendar days.

Let's assume that a new employee's salary is accrued and paid for the first 22 calendar days of April. Therefore, the average monthly number of calendar days in April attributable to days worked will be equal to

1.3.4 There is no billing period - calculation based on the tariff rate

It is unlikely that an employee would be sent on another paid leave on the day he was hired. However, by agreement of the parties, such leave may be granted, para. 2 tbsp. 122 Labor Code of the Russian Federation. For such a case, the algorithm for calculating average daily earnings is set to clause 6 of Resolution No. 922.

“If the employee did not have actually accrued wages or actually worked days for the pay period, before the start of the pay period and before the occurrence of an event that is associated with maintaining the average earnings, the average earnings are determined based on the tariff rate established for him, salary (official salary).”

Clause 6 of Resolution No. 922.

For example, on April 23, an employee was hired, he was assigned a monthly salary, and on the same day he went on vacation paid in advance. Since not a single day was worked before the event, the average daily earnings for vacation pay should be determined by dividing the monthly salary by 29.3.

1.4 Payment of vacations on working days

Usually vacations are granted in calendar days, Art. 120 Labor Code of the Russian Federation. But there are categories of workers who are granted vacations in working days.

- For employees who have entered into an employment contract for a period of up to two months, Art. 291 Labor Code of the Russian Federation.

- For seasonal workers, Art. 295 Labor Code of the Russian Federation.

In both of these cases, paid leave is provided at the rate of two working days per month of work. At the same time, in clause 11 of Resolution No. 922 The following is stated verbatim.

“The average daily earnings for paying for vacations provided in working days, as well as for paying compensation for unused vacations, are calculated by dividing the amount of actually accrued wages by the number of working days according to the calendar of a 6-day working week.”

Clause 11 of Resolution No. 922.

The billing period is determined in a standard way, paragraph 3 of Art. 139 Labor Code of the Russian Federation. This method of calculation does not depend on the employee’s work schedule.

1.5 Calculation of average earnings for payment in other cases

Calculation of average earnings in other cases (business trips, advanced training, etc.) depends on the method of recording the time worked.

1.5.1 Summarized working time recording

If an employee works according to a schedule with summarized working hours, then the average earnings are calculated based on the average hourly earnings. Valid in clause 13 of Resolution No. 922 The following is stated verbatim on this matter.

“When determining the average earnings of an employee for whom a summarized recording of working time has been established, except for the cases of determining the average earnings for payment of vacations and payment of compensation for unused vacations, the average hourly earnings are used.”

Clause 13 of Resolution No. 922.

It also established that average hourly earnings are calculated by dividing the amount of wages actually accrued for hours worked in the billing period by the number of hours actually worked during this period.

The product of average hourly earnings by the number of working hours according to the employee’s schedule in the period subject to payment equals average earnings.

1.5.2 Non-accumulated working time recording

The most typical schedule with non-accumulated working hours is a five-day work week. On the calculation of average daily earnings in other cases in para. 5 clause 9 of Resolution No. 922 The following is stated verbatim.

“The average daily earnings, except in cases of determining the average earnings for vacation pay and payment of compensation for unused vacations, is calculated by dividing the amount of wages actually accrued for days worked in the billing period, including bonuses and remunerations taken into account in accordance with paragraph 15 of these Regulations, by the number of days actually worked during this period.”

Paragraph 5 clause 9 Resolution No. 922

2. Conclusion

We hope that the material in this article will allow users to monitor and verify the correctness of calculation of average earnings in the 1C ZUP 3.1 program.

Reprinting and other full or partial reproduction and reproduction of site materials/articles (as well as their copying on other Internet resources) is not permitted.

Calculation of average earnings in the standard solution “1C: Salary and Personnel Management for Kazakhstan”

Date of publication: 08/16/2010

Calculating average earnings is one of the difficult aspects in calculating wages, since it is necessary to take into account a number of conditions that affect the calculation.

In the “ ” configuration, a full-fledged mechanism for calculating average earnings is automated: a flexible system of calculation settings is implemented in accordance with the options for calculating paid absences, accounting for indexation of earnings and accounting for incentive payments when calculating average earnings are automated.

To set up and group basic and additional charges regarding inclusion in the calculation of average earnings, a special plan of calculation types is provided "Average earnings".

All types of calculations are divided into 5 groups:

"Basic income"- includes accruals that must be taken into account when calculating average earnings, calculated from working days (hours), except in cases of calculating vacations and sick leave;

“Earnings for calculating sick leave”— includes accruals that must be taken into account when calculating average earnings to pay for sick leave;

— includes accruals that must be taken into account when calculating average earnings to pay for vacations;

“Bonuses fully taken into account in average earnings (accrued in proportion to time worked)”- includes accruals that are bonuses that must be taken into account when calculating average earnings in full, regardless of the time worked in the period for which the bonus is accrued (for example, a bonus with a calculation formula "Percentage");

“Bonuses partially taken into account in average earnings (accrued as a fixed amount)”- includes accruals that are bonuses, which must be taken into account when calculating average earnings in an amount proportional to the time worked in the period for which the bonus is accrued (for example, a bonus with the formula "Fixed amount" , "At the minimum wage" and others).

For accruals that do not need to be indexed when calculating average earnings, types of calculations are provided that contain the phrase “without indexation” in the name.

Important! After creating a new type of wage calculation, it MUST be included in the appropriate group for calculating average earnings.

The periods and amount of earnings indexation are stored in the information register “Earnings Indexation Coefficients”. To increase the official salary and reflect the fact of indexation, you must use the document “Personnel Transfer” (menu "Personnel records of organizations"- "Personnel accounting"— “Personnel movements of organizations”), in which you need to check the “Earnings Indexation” checkbox. During this process, the indexation coefficient will be calculated, defined as the ratio of the employee’s new official salary to his official salary before the increase.

To take into account the indexation of tariff rates for employees whose work is paid depending on the tariff category, when the rate changes, the document is intended « Entering earnings indexation coefficients" (menu "Calculation of salaries of organizations"— “Payroll calculation”— “Entering earnings indexation coefficients”). The document has the ability to automatically generate a list of employees for whom tariff categories have changed and calculate the indexation coefficient.

To calculate accruals based on average earnings in the “Salary and HR Management for Kazakhstan” configuration, the following documents are provided:

Accrual of vacation to employees of organizations.

Sick leave accrual.

Payment based on average earnings.

Calculation upon dismissal of an employee of an organization.

Registration of downtime in organizations.

The calculation of payment based on average earnings in the configuration is implemented according to a single principle. This approach is used to simplify the user’s understanding and control the correctness of the accrual results.

In each of the above documents, on the “Calculation of average earnings” tab, there is a tabular section with the calculation results for each month of the billing period. At the same time, for bonuses accrued over more than one month, the share of the bonus attributable to each month of the calculation period of average earnings, coinciding with the period for which the bonus was accrued, is displayed. For example, if a bonus was awarded in March 2010 to employee S.V. Drugov. for the first quarter of 2010 in the amount of 150 thousand tenge. When calculating average earnings, we will see that in the tabular part in this case there will be 3 lines with the accrual of “Premiums, fully taken into account in the average. earnings (accrued in proportion to time worked)” with an amount of 50 thousand tenge per month of the bonus period.

In the tabular section for each month there must be only one of the main types of calculation: “Basic earnings”, “Earnings for calculating sick leave” or “Earnings for calculating vacation pay”. Other types, including calculations without indexation, will be used only if basic charges have been configured for them.

The amount of time worked when calculating average earnings can be calculated in two ways:

according to the time actually worked in the billing period;

according to the time calculated based on their main schedule of the enterprise.

To calculate payment based on average earnings, two options for calculating paid time can also be used:

according to the employee’s actual work schedule;

according to the main schedule of the enterprise.

Options for collecting worked and paid time are determined by the settings of the accounting policy for personnel of organizations “Procedure for recording working time when calculating average earnings” and “Use of work schedules when paying average earnings”, respectively (menu "Company"— “Accounting policy”— “Accounting policies for personnel of organizations”).

The main schedule of the enterprise is indicated in setting up the accounting parameter on the “Main schedule” tab (menu "Company"— “Setting up accounting parameters”).

The determination of the unit of paid time (day or hour) depends on the “Summary accounting of working time” setting of the work schedule used to collect time worked for the calculated period of average earnings. If this setting is not set, then the calculation is made based on average daily earnings; if installed - according to the hourly average.

If payment based on average earnings was made and additional accruals occurred for previous months, the original payment document should be adjusted, since the program uses the average earnings calculation data recorded in the document and uses them in accruals “as is.”

After calculating and posting the document, you can receive two types of printed form:

the main form in which accruals for the billing period and bonuses accrued in the billing period are displayed in separate tabular parts;

a detailed form in which accruals for the billing period are displayed with the distribution of premiums by month.

Despite the fact that, in general, accruals based on average earnings occur uniformly, some documents have a number of features:

The document “Accrual of vacation for employees of organizations” can calculate compensation for unused vacation only in cases not related to the provision of compensation upon dismissal

The document “Payment based on average earnings” can calculate accruals with calculation formulas "According to average earnings" And “Additional payment up to average earnings”

In the document “Registration of downtime of organizations”, payment based on average earnings is made only if the type of downtime is indicated "Due to the fault of the employer"

In the document “Calculation upon dismissal of an employee of organizations”, when calculating average earnings for compensation for unused vacation, the type of calculation will be used “Earnings for calculating vacation pay”, to pay severance pay - "Basic income"

Thus, the application solution “Salary and Personnel Management for Kazakhstan” fully automates the complex process of calculating accruals based on average earnings, allows you to cover all possible conditions and eliminate possible errors.

We wish you success in your work!